Is JDS Uniphase a Safe Pre-Earnings Buy Opportunity?

2011-7-26 16:21:33 Iccsz Author:Spencer Knight

Intro:JDS Uniphase (JDSU) has been a rocket stock for decades. Unfortunately the stock has not always been a one way ticket to the moon. Just as fast as the share price rockets up, the stock can plummet.

JDS Uniphase (JDSU) has been a rocket stock for decades. Unfortunately the stock has not always been a one way ticket to the moon. Just as fast as the share price rockets up, the stock can plummet. An investor who has held JDSU since the IPO would have made millions of dollars and then lost millions just as fast. The company is without a doubt a spectacle to watch. However, with the recent slide, the question is whether or not JDSU is a good buy at the 14-15 level. With the earnings report coming next month, the current level may be a good opportunity with little downside risk if the position is closed out prior to earnings.

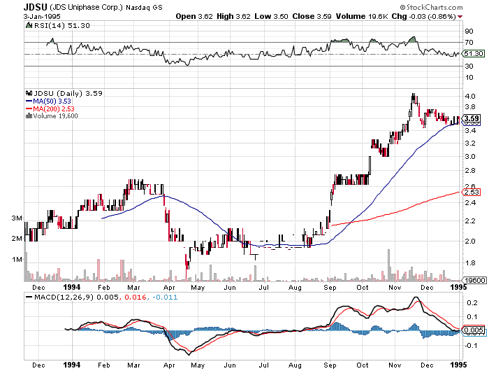

To begin, it is important to look at the lifetime of JDSU's stock to find similar patterns. Prior to 1995 (JDS Uniphase was not formed until 1999 when JDS Fitel merged with Uniphase Corporation; however I will refer to the company as JDSU when discussing events prior to 1999 to keep everything clear for investors), JDSU's share price did not grow out of the ordinary. In fact, the company was simply a small cap stock trying to make it in the booming technological world. From the inception of the stock to the beginning of 1995, the share price grew 74%. This may seem miniscule for a technology company by today's inflated standards, but to put it in perspective-- the Dow Jones only grew 3.6% over that same period.

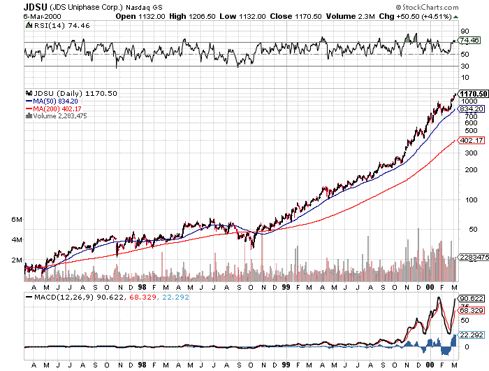

After 1995, JDSU's stock began a momentous run. Over the next two years, from 1995-1997, the stock rose 588%; along with a two for one split on June 4, 1996. This run began the train that took the stock to the all time split adjusted high of 1172.24. (Due to a 1 for 8 reverse split on October 17, 2006 JDSU's share price values are greatly inflated then what the actual values were prior to the reverse split.)

The stock grew an incredible 4,636% from the beginning of 1997 to March 2000. Not to mention the company approved three two for one stock splits prior to the high and another two for one split seven days later. It is nearly impossible to put this kind of run into perspective, because not many companies have grown to that level.

However, to attempt to put this in perspective I will provide a real life possibility. Let's say an investor decided to buy $2000 of JDSU stock at 24.75 after the 588% run, expecting the stock would continue the upward momentum. This investor would receive 80 shares. This same investor decides to hold JDSU for the long term and he does not sell until March 13, 2000. After splits, the original $2000 would turn into $1.34 million. Therefore a modest man could have been turned into a millionaire in just over three years.

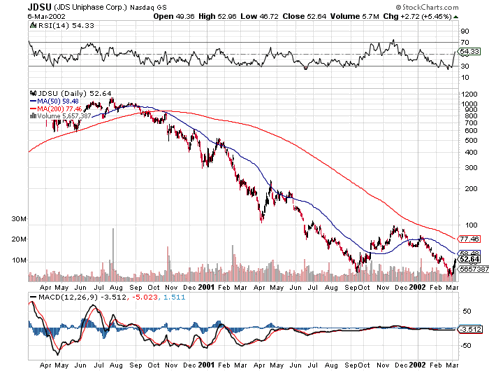

Just as quickly as the stock moved up, the share price plummeted back to more leisurely levels. The chart makes a perfect volcano as the stock went up very fast, then fell just as fast. Over the two years following the all time high the share price fell about 95%. The stock successful hit lower lows and lower highs until about mid 2005, when the stock hit a bottom at the 11 level. Over the next ten months the share price grew over 200%. This is important to remember because this pattern is similar to the current situation.

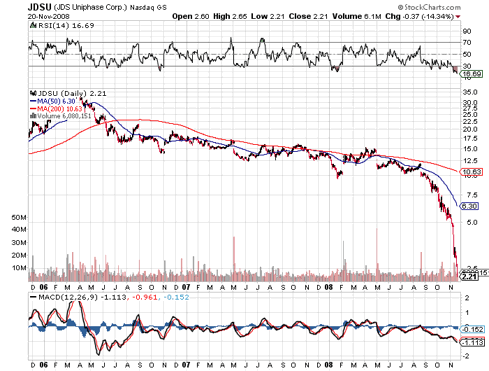

After the 2006 spike, the share price continued to fall year over year with no positive momentum for two and a half years. This dip reached a pinnacle in November 2008 when the share price fell to 2.21; which is just barely above the stock price 15 years earlier. It must be noted that many companies faced this same fate, however few had gone through the extreme success followed by utter failure that JDSU's stock saw.

Since this bottom the share price caught some positive momentum and began to run higher. The stock was going through a safe growth pattern until late October 2010 when the rocket we saw in the late 1990s began to come back. In less than four months, from October 28, 2010 to February 11, 2011, the stock grew an incredible 175%. Many people began calling for another dot com bust and a technology bubble like we saw in 2000. However, JDSU made this 175% run based on some strong indications that worldwide growth and demand was speeding up. However, after several other optical networking companies reported a down outlook, JDSU took a hit.

Since the recent peak earlier this year, the stock has fallen almost 50%. The low was reached on June 22nd at 14.38. The share price has began to move upward again with some positive buying momentum. However this buying momentum may not be a sign to buy. Since the stock has seen continued downward momentum for five months now, investors should wait to see if the share price will make a break up for a sustained period, or if the share price will give in to a lower low.

This brings us to the original question of whether or not JDSU presents a safe buying opportunity a month before earnings. Looking at the stock price, it appears the company has more room to run up than it does down. However Oclaro (OCLR) has continued a downward pattern all year. With that in mind, investors must note the majority of JDSU's share price movement has been due to analysts predicting the optical networking sector is slowing down, and other optical stocks giving negative outlooks. In contrast, JDSU has historically been very successful.

The past three earnings have been good enough to keep the stock price moving upwards. However, the two earnings prior to the most recent three were misses. After the May 5, 2010 earnings report the stock dropped 20% followed by a 4.5% drop the next day. It must be noted after this drop the share price began to bounce up and down very uncontrollably. After the August 25, 2010 earnings report the stock dipped a mere 4.7%, followed by a 5.6% slide the following four days. However it must be noted this dip led to the October 2010 run I discussed earlier.

More importantly, the three most recent earnings reports have been very solid. After the November 4, 2010 report the stock crawled 2.5%, followed by a 5% move over the next two days. The most impressive quarterly report came on February 3, 2011. The company reported an outstanding quarter and the share price jumped 27% in one day. Even more astounding the stock moved another 23.7% the following week. The most recent earnings release on May 4, 2011 was a bit more modest and the share price reacted accordingly. The following day the stock moved 7% with another 3.2% run over the next four days.

As you can see, the previous five earnings reports show a steady increase in expected earnings. However the increase in net income and EPS in the quarter ending January 1, 2011 set new standards for JDSU. More specifically-- net income grew 23,500% from JDSU's fiscal first quarter to second quarter. Also, EPS grew from 0.00 to 0.10 during this same period. This shows net income and EPS were far below respectable levels prior to 2011.

One of the most interesting aspects to JDSU's most recent earnings report is it beat the previous quarter in terms of net income and EPS. From the second fiscal quarter, which ended January 1, 2011, to the third quarter JDSU's net income increased another 63.5%. Also, earnings per share increased 60%. It is not surprising JDSU has encountered a dip in share price because the company has slowed down from the magical quarter that turned the stock into a rocket. This makes the recent drop in share price a strong buying opportunity because the company is still growing; just not at the same rate.

Another fact to consider before taking a position in JDSU prior to earnings is upgrades and downgrades. Overall analysts are comfortable with JDSU because the company has seven analysts rating the stock a strong buy, one a moderate buy and five analysts have a neutral or hold rating on the stock. Some of these recommendations can be found here (as well as I, II, and III). Most recently analysts have downgraded JDSU citing a slowing market for optical networking equipment.

Investors should take these warnings with all seriousness because developing countries are beginning to slow down growth. With that said, optical networking companies have a bright future as faster connections are needed for cell phones and internet. Also, JDSU's innovation separates the company from competitors such as Oclaro. JDSU continuously innovates new products that are faster and have multiple uses. For instance JDSU has been working with EMC (EMC) to provide faster storage capabilities. If JDSU and EMC can properly work in tandem, we may see a new kind of cloud storage in the future.

This, once again, leads us back to the question of whether to open a position in JDS Uniphase prior to the companies earnings report on August 24. In my opinion the stock has a bright future. In fact, some investors are concerned JDSU will miss expectations; I expect a healthy 5-15% run up over the next month. Granted much of this run up assumes no major debt setbacks will purge the market of past gains. With all things being equal, JDSU should be seeing the 17 range before earnings. However the stock will see some steady resistance at the 16.20 level. Therefore it may be better to wait to see if the share price can break that resistance before opening a position.

Opening any position in JDSU is a risky play because the stock is very unpredictable. I am assuming shorts will begin to place bets on a JDSU earnings miss, but based on the past earnings releases the company will at least match expectations. If the company reports an EPS of 0.18 as I am expecting, this will make the P/E ratio 34.6 if the share price does not move. With an EPS of 18 cents, JDSU's share price would have to move to the 24 level in order to keep the same P/E ratio of 55 that the stock holds today. This may be a speculative run, but if the last two decades have taught us anything; JDSU is a rocket stock.

To begin, it is important to look at the lifetime of JDSU's stock to find similar patterns. Prior to 1995 (JDS Uniphase was not formed until 1999 when JDS Fitel merged with Uniphase Corporation; however I will refer to the company as JDSU when discussing events prior to 1999 to keep everything clear for investors), JDSU's share price did not grow out of the ordinary. In fact, the company was simply a small cap stock trying to make it in the booming technological world. From the inception of the stock to the beginning of 1995, the share price grew 74%. This may seem miniscule for a technology company by today's inflated standards, but to put it in perspective-- the Dow Jones only grew 3.6% over that same period.

(JDSU chart from November 17, 1993 to January 3, 1995)

After 1995, JDSU's stock began a momentous run. Over the next two years, from 1995-1997, the stock rose 588%; along with a two for one split on June 4, 1996. This run began the train that took the stock to the all time split adjusted high of 1172.24. (Due to a 1 for 8 reverse split on October 17, 2006 JDSU's share price values are greatly inflated then what the actual values were prior to the reverse split.)

The stock grew an incredible 4,636% from the beginning of 1997 to March 2000. Not to mention the company approved three two for one stock splits prior to the high and another two for one split seven days later. It is nearly impossible to put this kind of run into perspective, because not many companies have grown to that level.

(JDSU chart from January 3, 1995 to January 3, 1997)

However, to attempt to put this in perspective I will provide a real life possibility. Let's say an investor decided to buy $2000 of JDSU stock at 24.75 after the 588% run, expecting the stock would continue the upward momentum. This investor would receive 80 shares. This same investor decides to hold JDSU for the long term and he does not sell until March 13, 2000. After splits, the original $2000 would turn into $1.34 million. Therefore a modest man could have been turned into a millionaire in just over three years.

(JDSU chart from March 6, 1997 to March 6, 2000)

Just as quickly as the stock moved up, the share price plummeted back to more leisurely levels. The chart makes a perfect volcano as the stock went up very fast, then fell just as fast. Over the two years following the all time high the share price fell about 95%. The stock successful hit lower lows and lower highs until about mid 2005, when the stock hit a bottom at the 11 level. Over the next ten months the share price grew over 200%. This is important to remember because this pattern is similar to the current situation.

(JDSU chart from March 6, 2000 to March 6, 2002)

After the 2006 spike, the share price continued to fall year over year with no positive momentum for two and a half years. This dip reached a pinnacle in November 2008 when the share price fell to 2.21; which is just barely above the stock price 15 years earlier. It must be noted that many companies faced this same fate, however few had gone through the extreme success followed by utter failure that JDSU's stock saw.

(JDSU chart from November 20, 2005 to November 20, 2008)

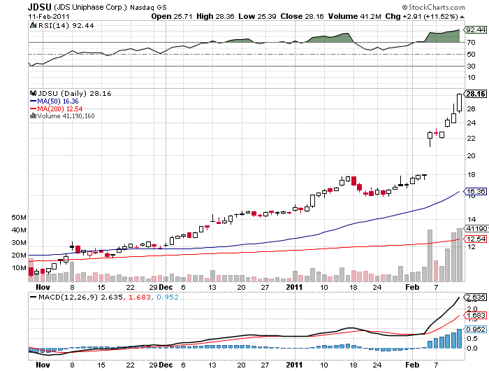

Since this bottom the share price caught some positive momentum and began to run higher. The stock was going through a safe growth pattern until late October 2010 when the rocket we saw in the late 1990s began to come back. In less than four months, from October 28, 2010 to February 11, 2011, the stock grew an incredible 175%. Many people began calling for another dot com bust and a technology bubble like we saw in 2000. However, JDSU made this 175% run based on some strong indications that worldwide growth and demand was speeding up. However, after several other optical networking companies reported a down outlook, JDSU took a hit.

(JDSU chart from October 28, 2010 to February 11, 2011)

Since the recent peak earlier this year, the stock has fallen almost 50%. The low was reached on June 22nd at 14.38. The share price has began to move upward again with some positive buying momentum. However this buying momentum may not be a sign to buy. Since the stock has seen continued downward momentum for five months now, investors should wait to see if the share price will make a break up for a sustained period, or if the share price will give in to a lower low.

(JDSU chart from February 11, 2011 to July 22, 2011)

This brings us to the original question of whether or not JDSU presents a safe buying opportunity a month before earnings. Looking at the stock price, it appears the company has more room to run up than it does down. However Oclaro (OCLR) has continued a downward pattern all year. With that in mind, investors must note the majority of JDSU's share price movement has been due to analysts predicting the optical networking sector is slowing down, and other optical stocks giving negative outlooks. In contrast, JDSU has historically been very successful.

The past three earnings have been good enough to keep the stock price moving upwards. However, the two earnings prior to the most recent three were misses. After the May 5, 2010 earnings report the stock dropped 20% followed by a 4.5% drop the next day. It must be noted after this drop the share price began to bounce up and down very uncontrollably. After the August 25, 2010 earnings report the stock dipped a mere 4.7%, followed by a 5.6% slide the following four days. However it must be noted this dip led to the October 2010 run I discussed earlier.

More importantly, the three most recent earnings reports have been very solid. After the November 4, 2010 report the stock crawled 2.5%, followed by a 5% move over the next two days. The most impressive quarterly report came on February 3, 2011. The company reported an outstanding quarter and the share price jumped 27% in one day. Even more astounding the stock moved another 23.7% the following week. The most recent earnings release on May 4, 2011 was a bit more modest and the share price reacted accordingly. The following day the stock moved 7% with another 3.2% run over the next four days.

As you can see, the previous five earnings reports show a steady increase in expected earnings. However the increase in net income and EPS in the quarter ending January 1, 2011 set new standards for JDSU. More specifically-- net income grew 23,500% from JDSU's fiscal first quarter to second quarter. Also, EPS grew from 0.00 to 0.10 during this same period. This shows net income and EPS were far below respectable levels prior to 2011.

One of the most interesting aspects to JDSU's most recent earnings report is it beat the previous quarter in terms of net income and EPS. From the second fiscal quarter, which ended January 1, 2011, to the third quarter JDSU's net income increased another 63.5%. Also, earnings per share increased 60%. It is not surprising JDSU has encountered a dip in share price because the company has slowed down from the magical quarter that turned the stock into a rocket. This makes the recent drop in share price a strong buying opportunity because the company is still growing; just not at the same rate.

Another fact to consider before taking a position in JDSU prior to earnings is upgrades and downgrades. Overall analysts are comfortable with JDSU because the company has seven analysts rating the stock a strong buy, one a moderate buy and five analysts have a neutral or hold rating on the stock. Some of these recommendations can be found here (as well as I, II, and III). Most recently analysts have downgraded JDSU citing a slowing market for optical networking equipment.

Investors should take these warnings with all seriousness because developing countries are beginning to slow down growth. With that said, optical networking companies have a bright future as faster connections are needed for cell phones and internet. Also, JDSU's innovation separates the company from competitors such as Oclaro. JDSU continuously innovates new products that are faster and have multiple uses. For instance JDSU has been working with EMC (EMC) to provide faster storage capabilities. If JDSU and EMC can properly work in tandem, we may see a new kind of cloud storage in the future.

This, once again, leads us back to the question of whether to open a position in JDS Uniphase prior to the companies earnings report on August 24. In my opinion the stock has a bright future. In fact, some investors are concerned JDSU will miss expectations; I expect a healthy 5-15% run up over the next month. Granted much of this run up assumes no major debt setbacks will purge the market of past gains. With all things being equal, JDSU should be seeing the 17 range before earnings. However the stock will see some steady resistance at the 16.20 level. Therefore it may be better to wait to see if the share price can break that resistance before opening a position.

Opening any position in JDSU is a risky play because the stock is very unpredictable. I am assuming shorts will begin to place bets on a JDSU earnings miss, but based on the past earnings releases the company will at least match expectations. If the company reports an EPS of 0.18 as I am expecting, this will make the P/E ratio 34.6 if the share price does not move. With an EPS of 18 cents, JDSU's share price would have to move to the 24 level in order to keep the same P/E ratio of 55 that the stock holds today. This may be a speculative run, but if the last two decades have taught us anything; JDSU is a rocket stock.

Keyword:JDSU

凡本網(wǎng)注明“訊石光通訊咨詢網(wǎng)”的所有作品,版權(quán)均屬于光通訊咨詢網(wǎng),未經(jīng)本網(wǎng)授權(quán)不得轉(zhuǎn)載、摘編或利用其它方式使用上述作品。已經(jīng)本網(wǎng)授權(quán)使用作品的,應在授權(quán)范圍內(nèi)使用,并注明“來源:訊石光通訊咨詢網(wǎng)”。違反上述聲明者,本網(wǎng)將追究其相關法律責任。

※我們誠邀媒體同行合作! 聯(lián)系方式:訊石光通訊咨詢網(wǎng)新聞中心 電話:0755-82960080-118 FLY

※我們誠邀媒體同行合作! 聯(lián)系方式:訊石光通訊咨詢網(wǎng)新聞中心 電話:0755-82960080-118 FLY